Domestic Reverse Charge Construction

UPDATE: HMRC HAVE DELAYED THE IMPLEMENTATION OF THESE NEW RULES BY 12 MONTHS – DEADLINE Is NOW 1st OCTOBER 2020 – SEE REVISED GUIDANCE HERE

Back in March 2017 the government published a consultation paper on fraud in the construction industry and the impact of fraud on collection of VAT and other taxes.

As a result of that consultation, from the 1st October 2019 the government is introducing significant changes to the way VAT is accounted for in the construction industry by introducing an ominously named ‘Domestic Reverse Charge’.

These changes and unfamiliar legalese terminology will no doubt send a shudder down the spine of many small subcontractors, most of whom undoubtedly already struggle to maintain timely and accurate books and records.

Arguably more concerning will be the seismic impact on larger contractors operating in construction who traditionally may have utilised the collection of VAT in cashflow forecasting.

From 1st October these companies will need to revise their models, stripping out the collection of VAT and without adequate funding to replace this 20% gap, the ramifications of these changes could create irrevocable liquidity issues.

Construction Subcontractors

If you are registered for VAT and CIS, where you would have previously charged VAT on your invoices, from 1st October, you will not.

You will however need to update your invoices with the correct terminology indicating you are making a supplies under the domestic reverse charge rules, and you will need to show the VAT you would have charged, or at the very least, the rate of VAT you would have applied to the supplies made.

In preparation for these changes you should contact your customers and establish if the reverse charge rules apply. It may be that if the customer has an interest in the land or project you are working on, you may still need to apply the normal VAT rules.

Constrction Contractors

Purchases

If you are registered for VAT and CIS and in receipt of services provide by a subcontractor, you will need to account for the VAT on those services under the reverse charge principles.

You will account for the input VAT as if you had been charged VAT, however you will then account for output VAT, as if you had made an equal and offsetting sale for the same amount as the purchase. This contra entry has the effect of netting off any VAT due in most instance.

Sales

If you are in a chain of contractors, then the rules above for Subcontractors may apply. The only difference will be if you are at the end of the construction chain and you are providing your services to an End User or ‘Intermediary Supplier’, that is an agent acting on behalf of the End User.

In these instances, you will apply the normal VAT rules to your supplies.

In preparation you must notify all of your subcontractors and inform them of the VAT position of the supplies they are making to you. You should also clarify if your customer is an End User.

Summary of VAT Changes

It is fair to say the introduction of these rules would be a challenge for any industry to adopt, however imposing these significant and complex changes in the construction industry could be seen as a step too far.

If you are operating in the construction industry it is essential you get the correct advice, planning and implementation of systems to manage these changes.

We can provide a complete review of your structure to ensure you are compliant with these new rules and that any cashflow issues are identified and managed.

We work with innovative, industry leading finance house providing whole of ledger facilities though to single invoice factoring and construction lending to ensure you have the cashflow to maintain operations throughout.

Contact us today to arrange a consultation and ensure you are prepared for 1st October 2019.

CIS340 – Check your CIS status

VAT Domestic Reverse Charge HMRC Guidance

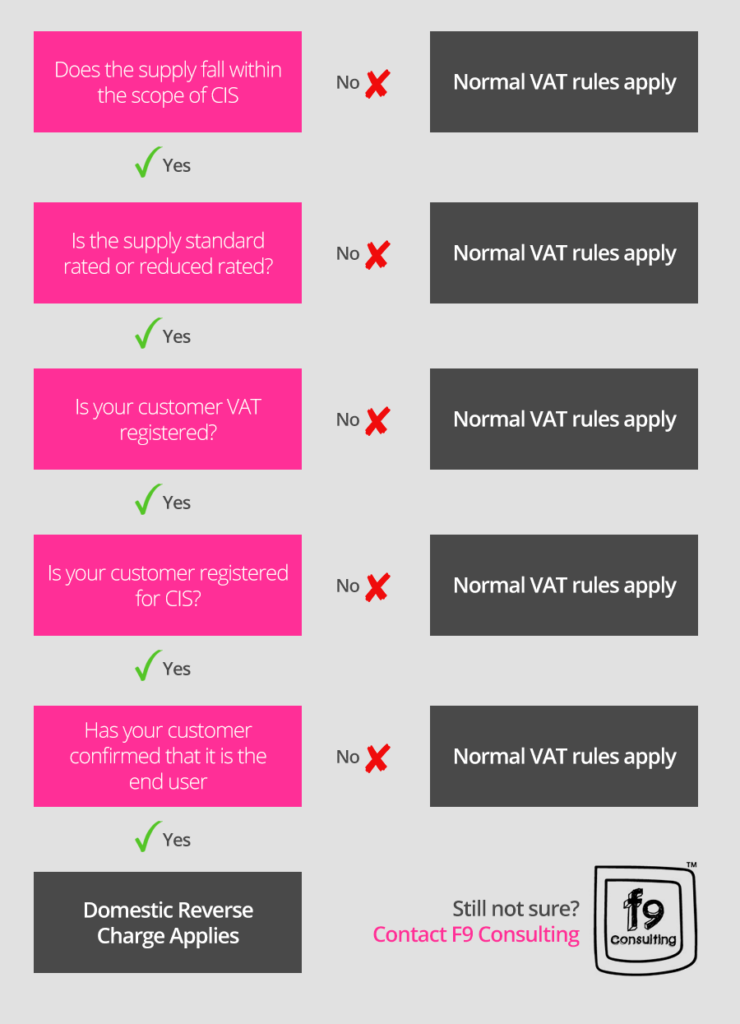

F9 Construction Domestic Reverse Charge Flow Chart

Domestic Reverse Charge