Tax Goals

With Christmas now but a distant memory, most of us are head down working diligently towards our New Year goals.

If you are operating a Limited company, 2018 is set to bring a wealth of opportunities as well as a host of threats.

Never before has planning been so essential, not only to mitigate tax liabilities, but also to prevent fines, penalties and enquiries resulting from non-compliance.

We have listed below a few hot topics that will impact owner managed businesses this year. How many effect you?

Dividend Taxation

In just two years we have gone from dividends being essentially tax free in the basic rate band to being replaced with a tax-free allowance. Initially set at £5,000, 2018/19 tax year will see this dividend allowance reduced to just £2,000.; Its anyone’s guess where this will end up, but I have a strong feeling it will not be increasing anytime soon.

Tip:

Ensure you plan your profit extraction carefully, there are additional allowances introduced in 2018/19 which may assist you claim new tax-free allowances.

We ensure our clients claim each exemption and allowance available to them. Are you confident your accountant is doing the same?

Entrepreneurs relief

Anti-avoidance introduced back in 2016 has made the opportunity to claim Entrepreneurs Relief on release of reserves more complicated. Circumstances need to be fully assessed and robust planning put in place prior to embarking on this journey in order to ensure the relief is available and will continue to be available.

A solvent liquidation is still a viable route to ER. This would typically be in situations where the owners are moving into a permanent role or different industry or where there is a husband and wife ownership structure.

Outside of liquidating the company to access reserves, shareholders now have the option of selling the company.

We work with venture capitalist and acquisition SPV’s who are actively searching to purchase companies with Reserves in excess of £50,000, even companies which are moribund.

If you have accumulated reserves you could receive as much as 90% of the company’s net asset value, allowing you to claim ER on the disposal and placing no restriction on your ability to continue operating in the same industry.

Tip:

If you need quick access to the accumulated cash in your company, with the correct planning and implementation, you could release all reserves at an effective tax rate below 10% within a matter of days. Contact us to discuss this further.

Higher Rate Tax Threshold Increase

What they take with one hand, they give with the other! Mr Hammond kindly increased the higher rate tax threshold by £1,000 commencing in 2018/19. Combine this with the £350 increase in tax free personal allowance, the detrimental change to dividend taxation is someway offset.

Tip:

It is essential you review and amend your salary levels in the Limited company each year, you can not only extract more cash in a tax efficient way, you can also increase savings in national insurance and corporation tax at the same time.

Salary reviews are an intrinsic part of our year end planning, are you receiving the same level of care from your existing accountant?

New Tax-Free Allowances

If you have small amounts of income from trading on the internet or renting out property and rooms, there are two new tax-free reliefs available which could potentially provide tax free income of £2,000.

Tip:

If you have relevant auxiliary activities in your limited company, it may be preferable to strip these out and declare them personally, allowing you to claim the tax-free trading allowance.

Trading whilst insolvent

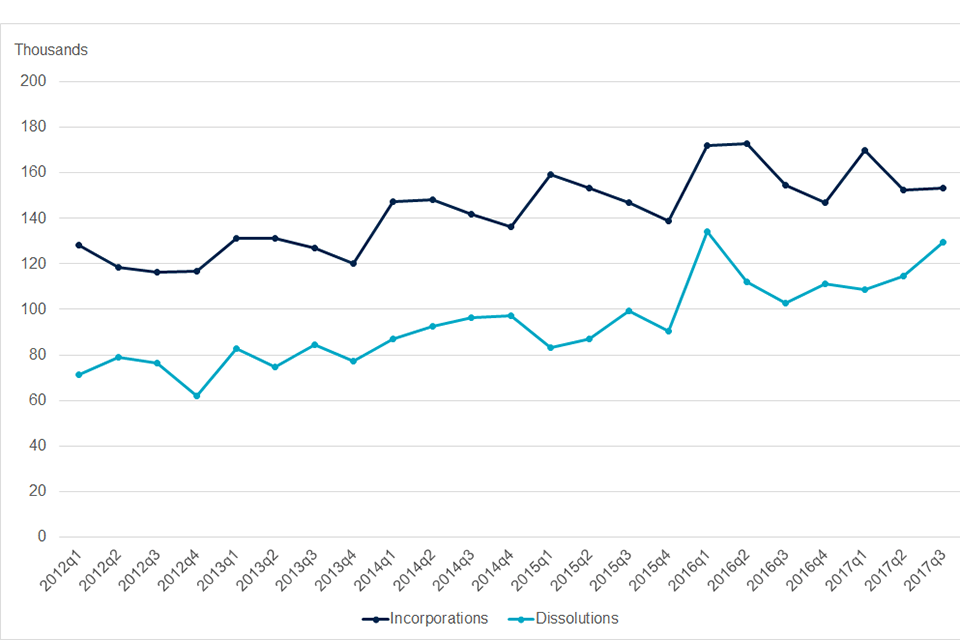

It’s a sad fact that more than most companies that incorporate will become insolvent or cease to trade.

Notably legislation in the UK is drafted to encourage entrepreneurism and not punish, unnecessarily, failures in attempts to achieve.

That said it is essential when acting as a director of a limited company that you understand your fiduciary duties, and ensure the company does not knowingly trade whilst insolvent.

Tip:

If you have issues with debt and are not paying liabilities when they fall due, be that trade creditors or HMRC, please contact us now.

Ignoring this issue could result in the veil of incorporation being removed and corporate debts being assigned to you personally.

Early intervention can ensure you remain personally protected and are able to trade and operate as a company director.

Company Dissolutions and Incorporations

Summary

Operating a Limited company today is fraught with risk. Copious compliance requirements combined with a multi-faceted tax regime provide a never before seen landscape.

To thrive in this new environment, it is essential you engage and form a strong relationship with your accountant.

If you would like to switch accountant, contact us today for a tailored fix fee quotation and FREE consultation. Don’t believe we can improve your situation? See what our current clients say about the service we provide.