Accountancy Payroll Services

Payroll – Real Time Information

Certified Accountants

Payroll – Real Time Information

Payroll – Real Time Information

Managing a business can be challenging enough without adding additional legal and compliance obligations.

With the introduction of real time reporting, it is now a requirement to inform HMRC of all payments made to staff, either before or on the pay date. If this is not done, or it is done late, then you can expect a penalty starting from £100 per month!

We can take over the responsibility for your payroll. We are able to ensure gross to net calculations are correct, processing statutory payments and deductions including Sick, Maternity, Paternity, Student Loans and Court Orders, and during COVID times, we can also process your staff furlough claims.

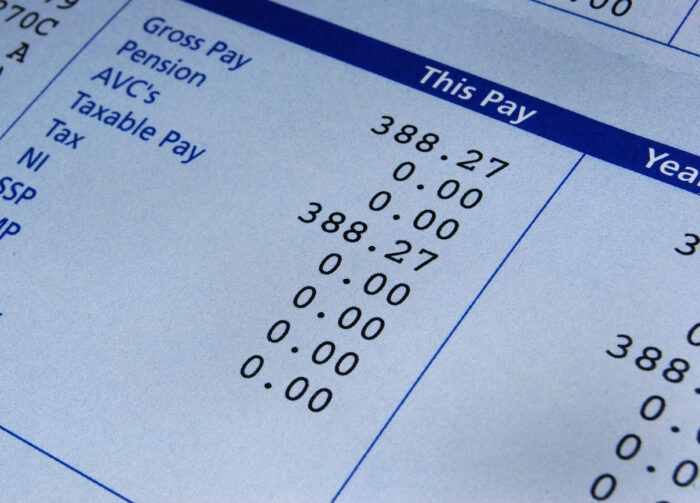

We provide electronic or hardcopy payslips, P45’s and P60’s along with a comprehensive P32 cross tab report and Workplace Pension Report detailing all payments and deductions in the period, allowing you to make payments and update bookkeeping software with one simple journal.

If you would like to free yourself from the operative burden of RTI payroll, please contact us at our Brentwood or Canary Wharf offices to discuss how we can integrate with your company and take on the task.

The law on workplace pensions has changed. Every employer with at least one member of staff now has new duties, including enrolling those who are eligible into a workplace pension scheme and contributing towards it. Even if you are a sole director operating a PAYE scheme you will have statutory obligations under AE.

Over 8,000,000 people have been automatically enrolled into a pension scheme this this process began. We can help you set up a workplace pension and operate your payroll in compliance with the rules.

Fines are harsh with regards to AE non compliance, there is a fixed penalty of £400 for late filing of a declaration of compliance, even if it later transpires that you are indeed compliant with your obligations. If you continue to be delinquent then fines will move to escalating penalty notices, moving to a maximum of £10,000 per day! Please do not assume this is scaremongering, the TPR have issued penalties at this level and seem mighty keen to continue doing so, see latest cases here.

Yep it’s here – You will need a workplace pension, contact us today.

We are offering fixed fee packages for the government backed NEST pension, for small employers with fewer than 5 employees our fees are fixed at £450 for the implementation of a workplace NEST pension.

We can provide a tailored quote for the implementation of other pensions, please contact us to discuss.

If you are operating a PAYE scheme, you will need to take action under auto enrolment, do not leave it until the last minute, penalties for non compliance are severe.

Jake Ashworth-Jones

19 days ago

If you're shopping around for an accountant and are, as I was, uncertain about who to go for; I can put your mind at rest and say that F9 are definitely one of the good guys! ...More