If you have not declared all of your income, it is not too late, F9 can bring your tax affairs up to date and arrange payment terms that work for you.

Paying tax is not optional, if you are caught evading tax you will be at the mercy of the penalties regime and in extreme examples, you could be looking at a criminal record and a lengthy prison sentence as this recent case demonstrates:

“Mr Baker has been jailed for two years today for the £1million tax fiddle”

Contact us now to get on top of your tax affairs.

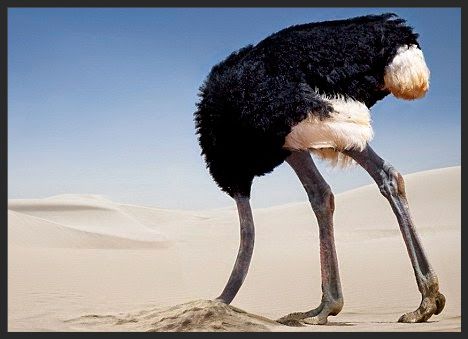

Below are examples of the circumstances in which HMRC will generally consider commencing a criminal, rather than civil investigation. Hoping a tax issue will go away is not an option, you must act now.

HMRC Criminal Investigation Markers

- where materially false statements are made or materially false documents are provided in the course of a civil investigation

- in cases involving the use of false or forged documents

- where an individual holds a position of trust or responsibility

- where deliberate concealment, deception, conspiracy or corruption is suspected

- where there is a link to suspected wider criminality, whether domestic or international, involving offences not under the administration of HMRC

- in cases of organised criminal gangs attacking the tax system or systematic frauds where losses represent a serious threat to the tax base, including conspiracy

- where, pursuing an avoidance scheme, reliance is placed on a false or altered document or such reliance or material facts are misrepresented to enhance the credibility of a scheme

- in cases involving importation or exportation breaching prohibitions and restrictions

- in cases involving money laundering with particular focus on advisors, accountants, solicitors and others acting in a ‘professional’ capacity who provide the means to put tainted money out of reach of law enforcement

- where the perpetrator has committed previous offences / there is a repeated course of unlawful conduct or previous civil action

- in cases involving theft, or the misuse or unlawful destruction of HMRC documents

- where there is evidence of assault on, threats to, or the impersonation of HMRC officials